Total taxes taken out of paycheck

And 137700 for 2020Your employer must pay 62 for you that doesnt come out. If youve underpaid so far subtract the amount youre on track to pay by the end of the year at your current level of withholding from the amount you will owe in total.

Paycheck Calculator Take Home Pay Calculator

Social security Medicare 765 of gross up 137700 gross then 145 after Federal income tax 12-22 of gross your effective rate is dependent on how.

. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. The employer portion is 15 percent and the.

Total income taxes paid. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. What percentage of my paycheck is withheld for federal tax.

With the 2019 tax code 62 of your income goes toward social security and. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

Welcome to California taxes. Amount taken out of an average biweekly. The amounts taken out of your paycheck for social security and medicare are based on set rates.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. What is the percentage that is taken out of a paycheck. In 2021 only the first 142800 of earnings are subject to the social security.

Amount taken out of an average biweekly paycheck. Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. Until 2020 you could reduce the amount of taxes taken out of your paychecks by claiming allowances on your W-4.

That changed in 2020. For a hypothetical employee with 1500 in weekly pay the. For a single filer the first 9875 you earn is taxed at 10.

Federal income taxes are paid in tiers. An employee who makes 165240 a year collects semi-monthly paychecks of 6885 before taxes and any retirement-plan withholding. FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings for a total of 765.

What percentage of taxes are taken out of payroll. Though Medicare tax is due on the. Now you claim dependents on the.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. The federal government collects your income tax payments. Each employer withholds 62 of your gross income for Social Security up to income of 132900 for 2019.

Total annual income Tax liability.

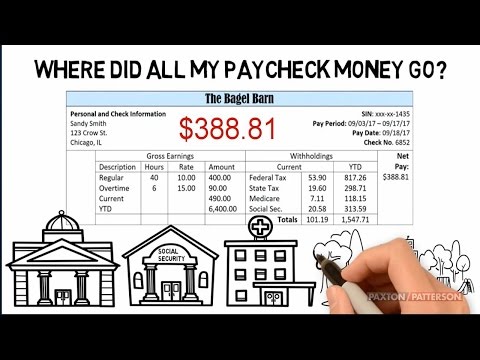

Understanding Your Paycheck Youtube

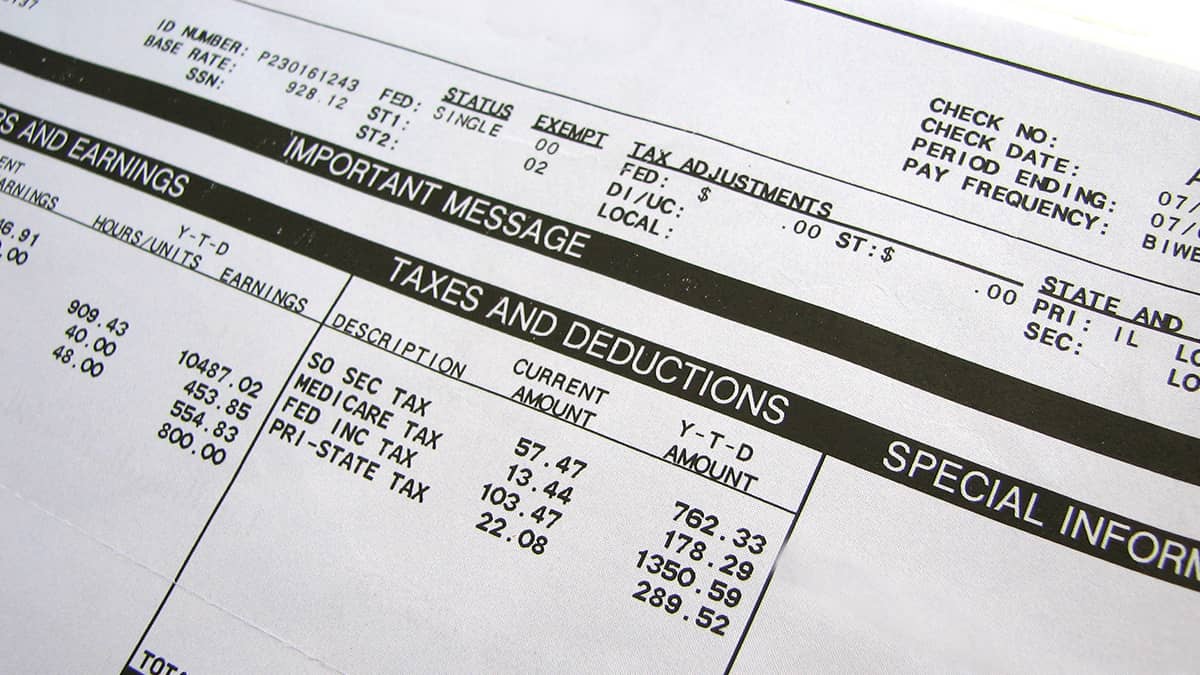

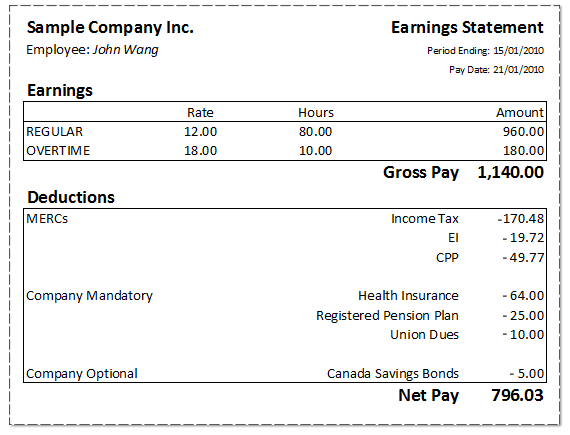

Pay Stub Meaning What To Include On An Employee Pay Stub

Paycheck Calculator Online For Per Pay Period Create W 4

Mathematics For Work And Everyday Life

Mathematics For Work And Everyday Life

Understanding Your Paycheck

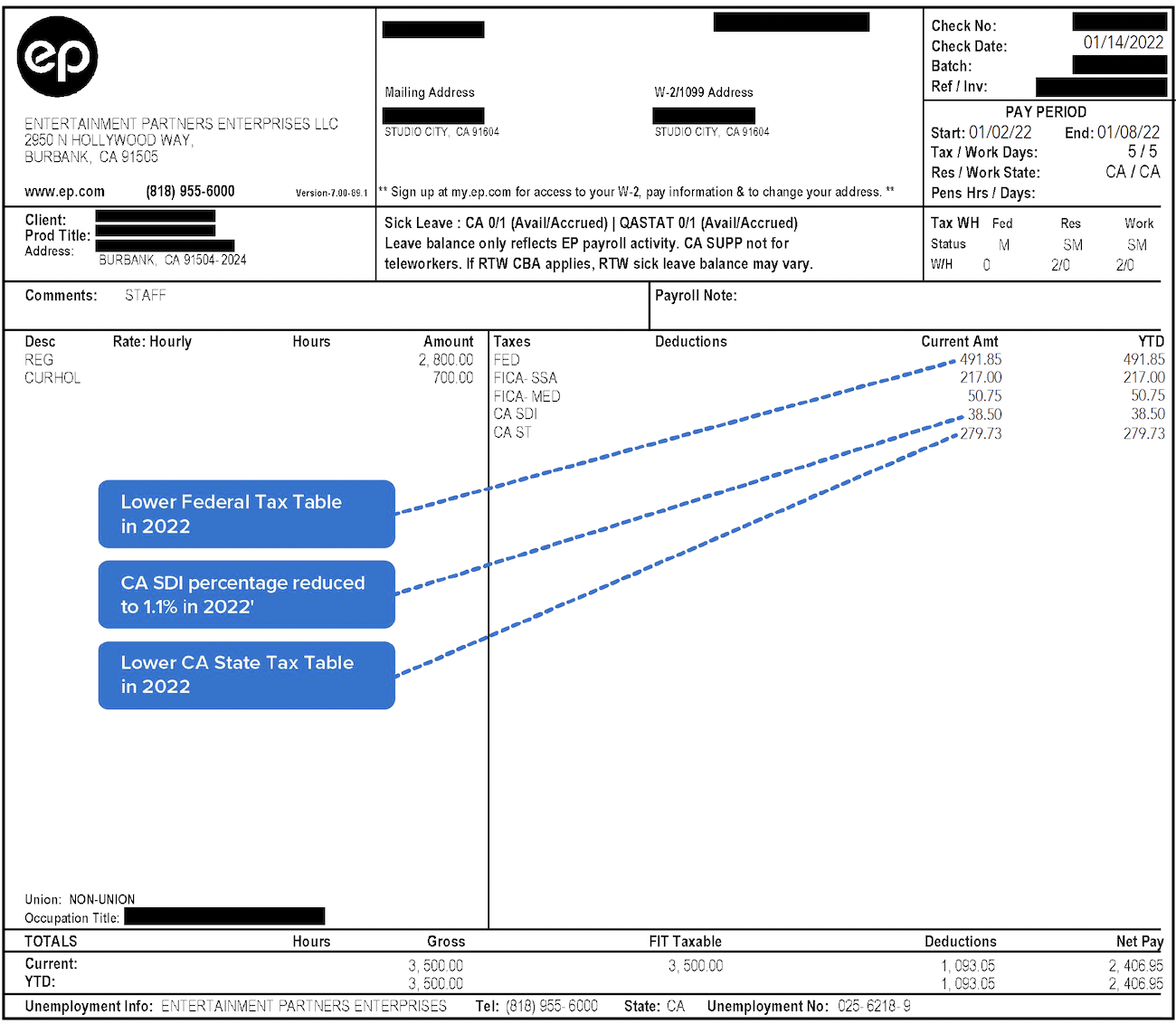

Decoding Your Paystub In 2022 Entertainment Partners

Tax Information Career Training Usa Interexchange

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How Does A Paycheck Look Like In Canada What Are The Deductions Quora

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Download Bonus Paystub Template 01 Paycheck Prepaid Debit Cards Paying

Taxes On Paycheck Factory Sale 57 Off Www Ingeniovirtual Com

The Measure Of A Plan

The Measure Of A Plan